High-Converting Debt Settlement Leads

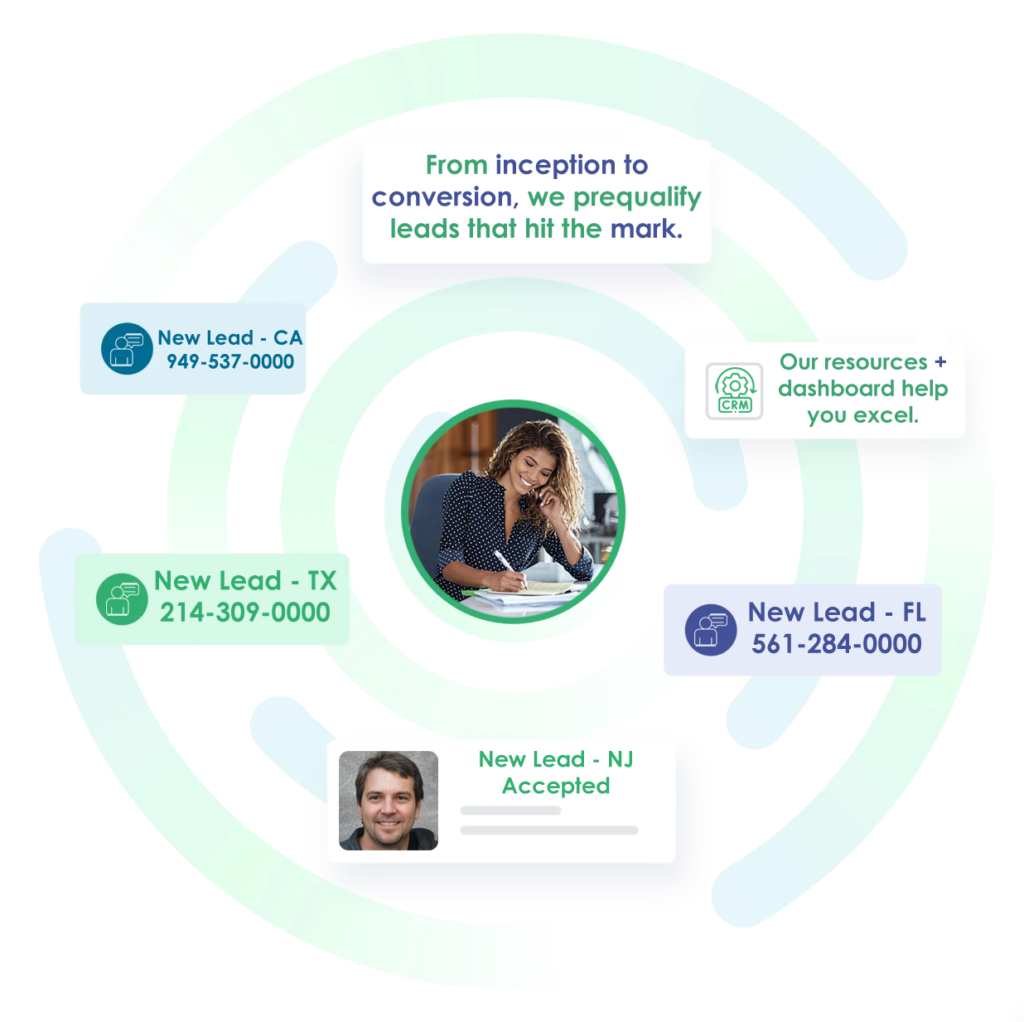

Our lead generation programs are specifically tailored to connect debt specialists and arbitrators with pre-qualified, high-intent applicants.

Whether you're established or recently growing, we provide the tools and support to expand your client base. Let us help you scale with confidence and drive results that convert.

Experts in Debt Settlement Leads

We excel in delivering top-tier Debt Settlement live transfers and qualified data leads.

With today’s economic uncertainties, financial stability is more important than ever. Our services bridge the gap between consumers in need and experienced debt specialists, providing them with the support and solutions to regain control of their financial health.

Our Services

With national credit card debt reaching a staggering $1.14 trillion, we’re laser focused on aiding U.S. consumers lighten the burden.

At Expert Lead Source, we go far beyond simply providing leads—we deliver highly qualified debt settlement candidates. Every lead is carefully vetted and tailored to meet your exact specifications, ensuring they are the best fit for debt relief services.

Our leads originate from meticulously completed online forms, print campaigns, and digital media. This multi-channel approach ensures that you’re connecting with unsecured debt holders actively seeking solutions, giving you access to the most relevant prospects.

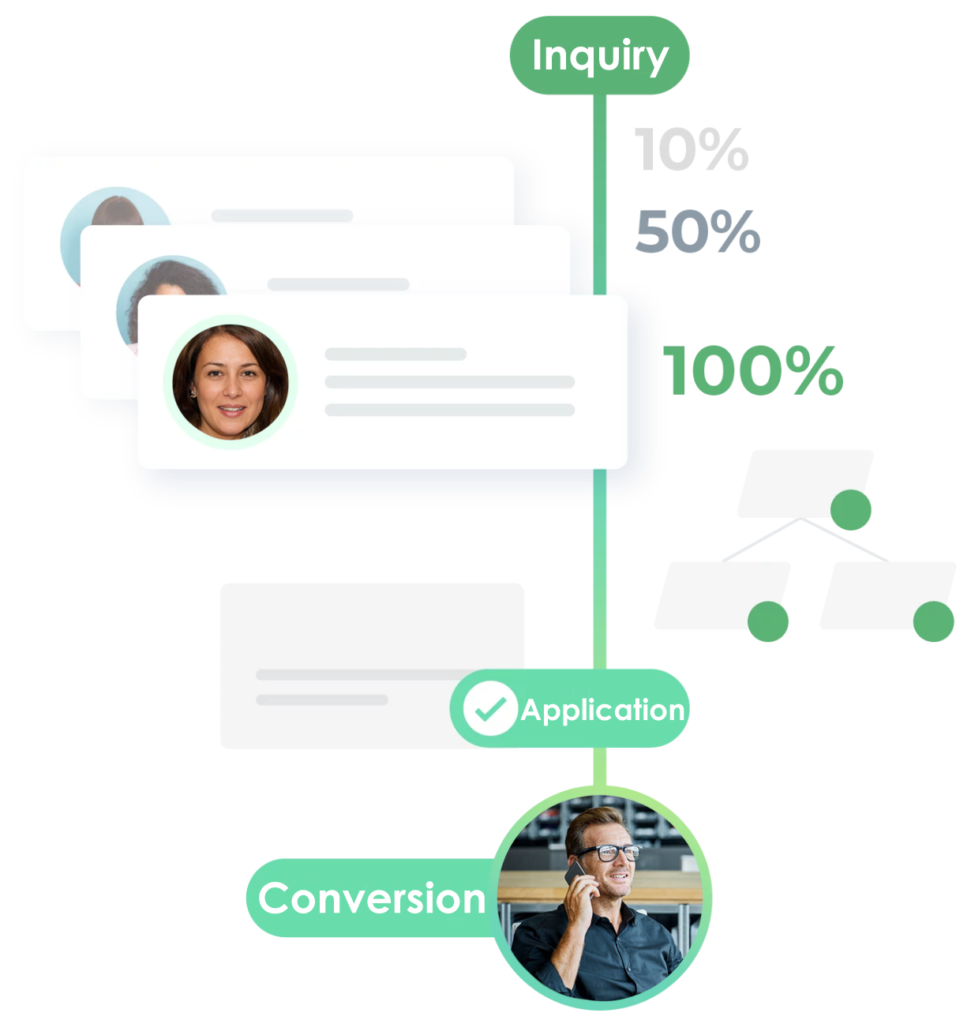

Connections Made at Every Stage

Our exclusive lead generation model pinpoints debt holders who are prime candidates for debt settlement, ensuring that each lead is high-quality and ready for further action.

Customizable by volume and available nationwide, our leads come directly from debt holders actively seeking debt relief assistance. Pre-qualified and vetted, these leads are delivered quickly for thorough consultations.

This precision-targeting process yields top-performing debt settlement prospects, maximizing your opportunity for conversion and business growth.

Affordability and Value

Boost your marketing ROI with our results-focused approach, blending smart, data-driven digital marketing with a personal touch. By integrating AI and a human-centered strategy, we help you save valuable time and money, allowing you to focus on your core strengths while guiding qualified debt settlement leads to the assistance they need.

As a recognized leader in debt settlement lead generation, Expert Lead Source leverages cutting-edge digital strategies to generate thousands of inquiries each month. Our expert team rigorously evaluates each lead based on your criteria, ensuring only the highest-quality prospects are delivered to you.

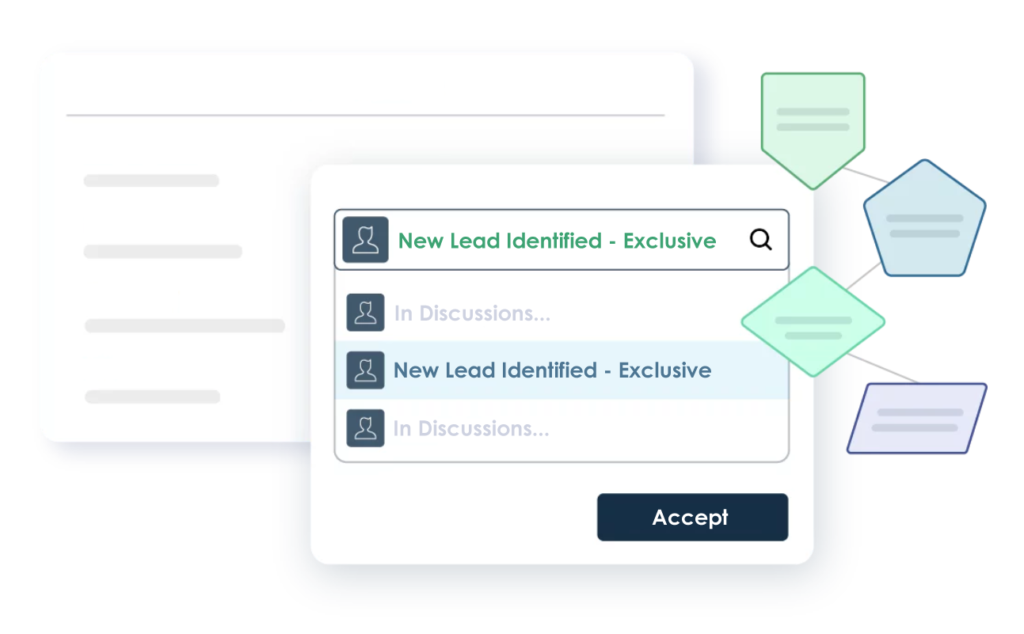

Exclusivity Matters

Our debt settlement leads are designed for exclusivity, connecting you directly with qualified debt holders who are actively seeking debt relief in their state. Each lead is exclusive to your business, ensuring you receive immediate access to potential clients ready for consultation.

We cut through the clutter of traditional digital advertising by skipping unnecessary clicks, impressions, or unengaged users. Instead, we offer a streamlined, cost-effective solution, delivering pre-screened, high-intent prospects straight to you for a more targeted and efficient marketing approach.

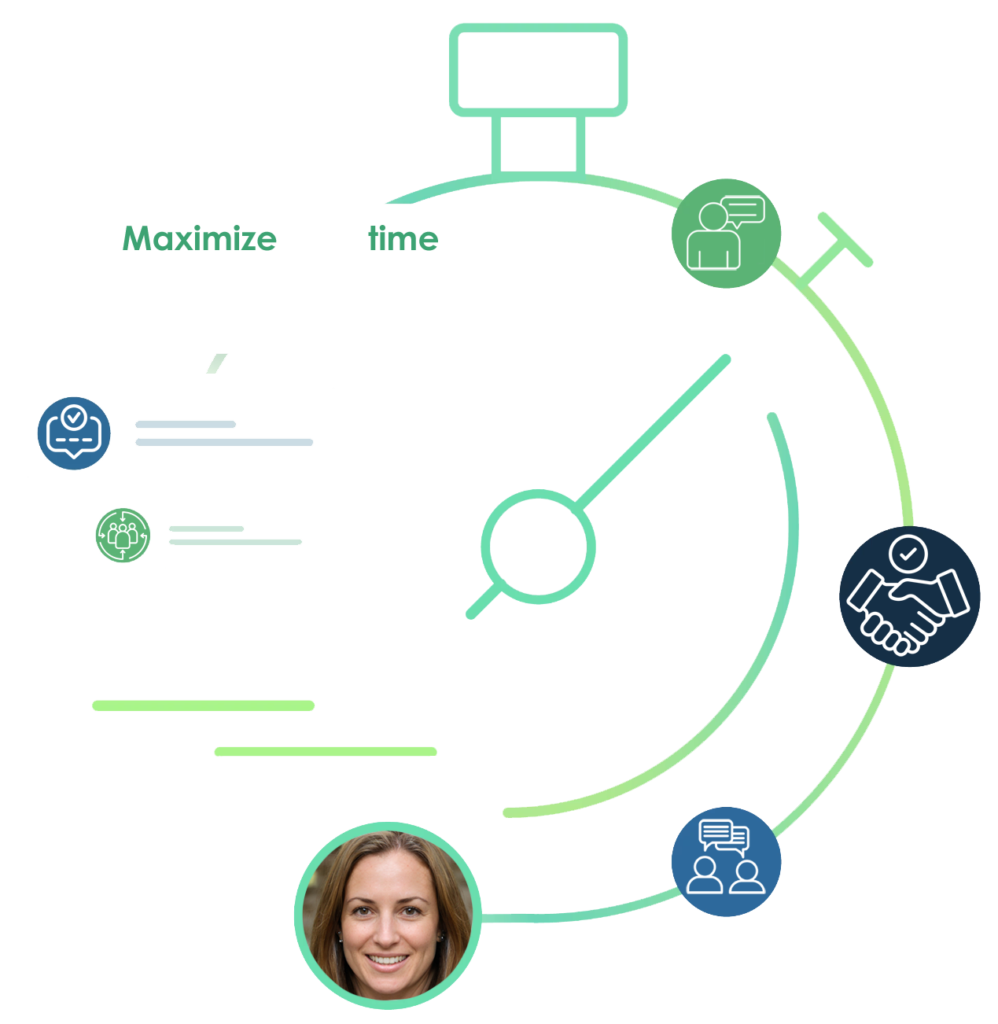

Rapid Delivery

Get connected with debt holders who are actively seeking a debt settlement option. Our streamlined process delivers hot, fresh, and exclusive leads right to your team—perfectly timed for immediate consultation.

Experience the power of real-time, high-quality prospects, allowing you to assist debt relief clients when they’re most ready for solutions. Enjoy unbeatable swiftness and lead quality!

Here's what sets us apart:

Exclusive Lead Ownership

Every lead is 100% yours, no sharing with competitors.

Instant Data Delivery

Get leads delivered in real-time, ensuring faster follow-up.

Monitored Transfers

All live transfers are attended, so you get qualified, ready-to-talk prospects.

Simple Lead Acquisition

A hassle-free process for acquiring leads quickly and efficiently.

Easy-to-Use Dashboard

Manage and track all leads from a convenient platform.

No Long-Term Contracts

Stay flexible with no binding commitments.

Zero Setup Fees

No data processing fees or hidden costs.

Only Pay for Qualified Leads

Sensible replacement policy ensuring leads are viable and want to hear from you.

All Leads Validated For:

- $10,000 or more in Unsecured debts

- Verification of income

- Late or facing payment difficulties

- Not already enrolled in a relief program

- Monthly payment capacity

- Active desire to receive a quote

- Geo targeting w/in licensed states

Debt Settlement Script Certification:

Hi, is this _________? My name is _________ and I’m reaching out from the Debt Reduction Group. We received your recent request, and it looks like you’re interested in obtaining a debt settlement assessment, is that right?

👍🏼YES: Proceed with the application.

👎🏼NO: Thank them for their time and exit the call.

Great, it appears you could qualify for a complimentary debt relief evaluation, which could help you take a big step towards financial freedom.

Contact Consent Notice:

*Before going further, I want to mention that this call is being recorded for quality and training purpose. And you may be connected to a specialist provider even if your number is on any Federal and/or State Do-not-call list. Consent is not a condition of purchase, and there’s no cost or obligation. Is that okay with you?

👍🏼YES: Proceed with the application.

👎🏼NO: Thank them for their time and exit the call.

Perfect! Once you qualify, you can enjoy a range of valuable benefits, such as:

- Reduce your debt: Negotiate with creditors to settle for less than you owe, helping you clear your financial obligations faster.

- Gain a fresh start: Become debt-free in as little as 24-36 months through Debt Resolution programs.

- Streamline your payments: Consolidate multiple debts into one manageable repayment plan.

- Avoid bankruptcy: Skip the long-term damage bankruptcy can cause to your credit score.

- Stop collection harassment: Gain legal protection from aggressive debt collectors.

We have a dedicated team of specialists ready to offer you a free, no-obligation debt review with tailored options just for your situation. Would you be interested in speaking with one of them right now?

👍🏼YES: Proceed with the application.

👎🏼NO: Confirm a better time to call back.

Excellent! We’ll need to ask a few questions to guide the next steps in your evaluation.

Screening Questions:

Let’s go ahead with the screening process:

How much total credit card and unsecured debt do you have? ($10K minimum required)

- Eligible: Credit card, medical bills, unsecured personal/business debt

- Non-eligible: Student loans, IRS tax debt, mortgage debt, car payments

How much are your monthly payments?

Are you behind or struggling with payments?

Who are your main creditors?

Have you filed for bankruptcy?

Are you employed, working, or retired?

What’s your monthly or annual income?

Eligibility Confirmation:

Great news! You’ve been pre-qualified for a complimentary debt relief assessment. Are you available to chat with a specialist right now and explore your options?

👍🏼YES: One moment while I connect you.

👎🏼NO: When would be a better time to reach you and connect you with a dedicated specialist?

Connecting:

Please stay on the line while I transfer you to a representative who can walk you through the program’s key aspects.

– Lead routed as a warm transfer.

– Call forwarded to specialist.

– Data successfully posted to provided CRM and email inbox.

Thank You!

Lead Example:

*Date: 9/18/2024 10:52

*Lead Ref: 29501427

*Segment: Debt Settlement

Applicant Information:

*First Name: Kelly

*Last Name: Ulman

*Phone-1: 813-207-****

Phone-2: 941-875-****

*Email: kellbell*****@gmail.com

*Address: 37942 N. Suwanee Ave.

*City: Tampa

*State: FL

*Zip: 33604

Financial Information:

*Total Debt: $31,675

*Income: $54,000 / year

Status: W-2

Employed: 27 years

Creditor Details:

1st Creditor: Capital One

*Debt Type: Credit Card

Balance: $12,750

Payment Amount: $450

Payment Lates: Current (facing hardship)

2nd Creditor: PNC Bank

Debt Type: Credit Card

Balance: $8,000

Payment Amount: $225

Payment Lates: Current (facing hardship)

3rd Creditor: Citi

Debt Type: Credit Card

Balance: $10,925

Payment Amount: $300

Payment Lates: 60-days late

Transfer Details:

*Call Status: Connected

*Specialist: Gary Young

*Transfer Agent: Anita Foster

*Order #: 24083175

Call Notes:

Kelly is working but faced cut backs with her employer. Experiencing payment hardships. Ready to talk with a debt relief specialist about debt settlement options to help lower monthly expenses.

IP Address: 97.76.232.230

* required

Let’s Advance on Your Next Conversion!

For cutting-edge marketing that surges ahead in the modern digital frontier, contact Expert Lead Source today and experience conversion power!