Loan Modification Leads that Convert New Sales

Empower your home retention business with our custom-fit lead solutions, designed to help you scale efficiently and achieve growth on your terms.

Experts in Loan Modification Leads

Unlock exclusive access to high-quality loan modification live calls and carefully vetted data leads.

For distressed mortgage holders aiming to retain homeownership, a loan modification can make a world of difference. With our expertise, we bridge the gap—connecting motivated homeowners with home retention specialists who provide customized options to meet each client’s unique financial and homeownership objectives.

Our Services

With over 180,000 Americans facing foreclosure filings each year, distressed homeownership has never been greater. With that comes a multitude of different circumstances with plenty of solutions.

We don’t just generate leads—we connect you with underwater borrowers who are highly motivated to keep their property. Each lead is meticulously vetted to align with your specific home retention requirements, ensuring you receive top-tier applicants who need your help.

Our leads come from a precision blend of digital engagement, targeted media, and optimized online forms—delivering homeowners actively seeking loan modification solutions to reshape their financial future.

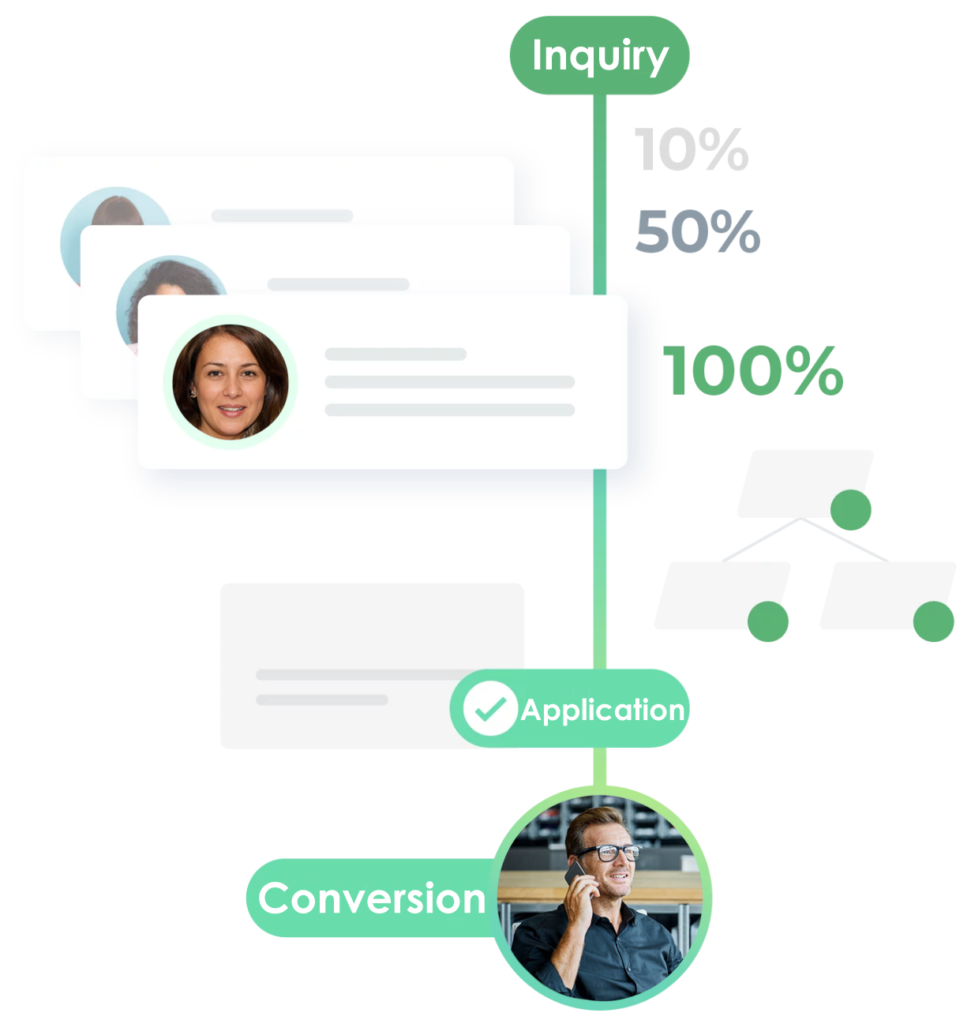

Connections Made at Every Stage

Our advanced lead generation system zeroes in on homeowners facing foreclosure who are actively seeking loan modification solutions, providing you with premium, high-conversion opportunities.

With fully customizable lead volumes nationwide, we deliver engaged, pre-qualified homeowners right to your team, ready for a supportive, results-driven conversation.

This powerful strategy fuels your success, bringing you targeted foreclosure leads that enhance conversions and support your growth.

Affordability and Value

Maximize your outreach with our precision-targeted approach, combining AI-driven insights and digital marketing with a human touch. We focus on connecting qualified homeowners facing foreclosure directly with the loan modification solutions they need, so you can focus on delivering results.

As a trusted leader in foreclosure lead generation, we utilize cutting-edge digital strategies to create thousands of homeowner inquiries each month. Our dedicated screening team hand-selects each lead to meet your exact criteria, providing only the most relevant, high-conversion prospects.

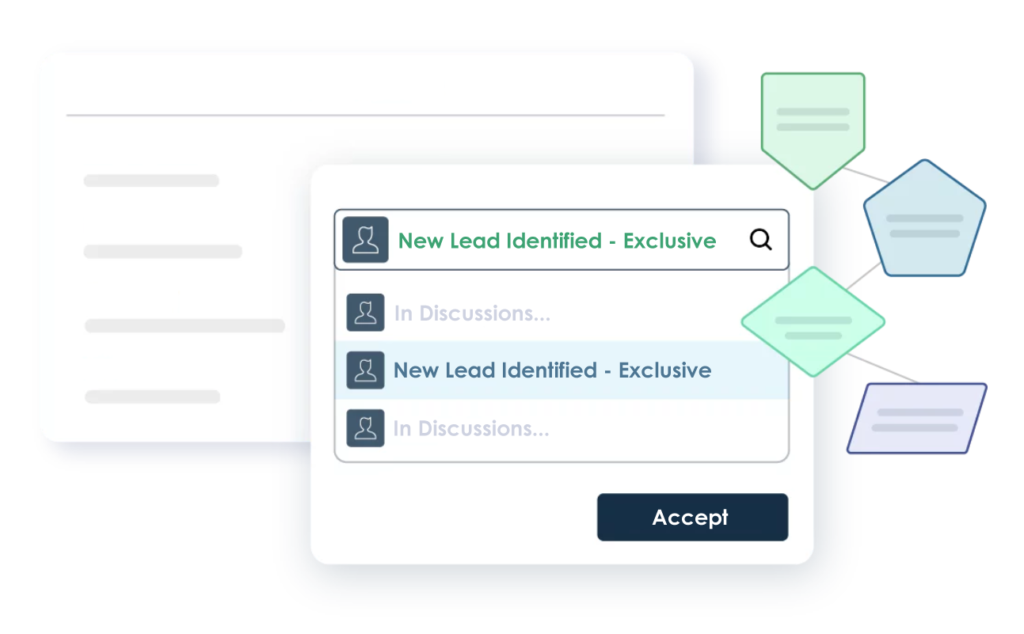

Exclusivity Matters

Our foreclosure leads are exclusive, carefully curated, and laser-focused on quality.

We connect you with motivated homeowners who are actively seeking loan modification assistance in their state, providing leads ready for immediate, meaningful conversations.

Prioritizing real intent over passive clicks, our approach delivers a more dependable and cost-effective alternative to traditional marketing, driving stronger results with each lead.

Rapid Delivery

Connect instantly with motivated homeowners facing foreclosure, delivered in real time for immediate follow-up.

Our strategy provides exclusive, high-intent leads at the critical moment they’re ready to discuss loan modification options. Experience unmatched lead quality and timeliness!

Here's what sets us apart:

Exclusive Lead Ownership

Every lead is 100% yours, no sharing with competitors.

Instant Data Delivery

Get leads delivered in real-time, ensuring faster follow-up.

Monitored Transfers

All live transfers are attended, so you get qualified, ready-to-talk prospects.

Simple Lead Acquisition

A hassle-free process for acquiring leads quickly and efficiently.

Easy-to-Use Dashboard

Manage and track all leads from a convenient platform.

No Long-Term Contracts

Stay flexible with no binding commitments.

Zero Setup Fees

No data processing fees or hidden costs.

Only Pay for Qualified Leads

Sensible replacement policy ensuring leads are viable and want to hear from you.

All Leads Validated For:

- Verified homeowner

- Property selects:

– Single family

– Townhome

– Condominium - 2+ months past due mortgage

- Intends to keep home

- Mortgage balance exceeds $150K+

- Verification of income

- Active desire to receive a quote

- Geo targeting w/in licensed states

Loan Modification Script Certification:

Hi, is this _________? My name is _________ and I’m reaching out from the Rescue Homeowner Group. We received your recent request, and it looks like you’re interested in obtaining a home retention assessment, is that right?

👍🏼YES: Proceed with the application.

👎🏼NO: Thank them for their time and exit the call.

Great, it appears you could qualify for a complimentary loan modification evaluation, which could help you take a big step towards financial freedom.

Contact Consent Notice:

*Before going further, I want to mention that this call is being recorded for quality and training purpose. And you may be connected to a specialist provider even if your number is on any Federal and/or State Do-not-call list. Consent is not a condition of purchase, and there’s no cost or obligation. Is that okay with you?

👍🏼YES: Proceed with the application.

👎🏼NO: Thank them for their time and exit the call.

Excellent, well it’s worth noting that modifying your mortgage has several potential benefits, such as:

Designed for those facing tough times, such as job loss or unexpected medical bills.

Prevent foreclosure by adjusting your mortgage to fit your current financial situation.

In some cases, lenders may agree to reduce the principal balance.

Flexible payment plans allow for extended terms or temporary interest rate reductions.

Keep your home and lower your payments, making it easier to stay where you belong.

- Provides legal protection by securing an official agreement with your lender on the new terms.

Connecting:

Our team of Home Retention Specialists who operate in your state can provide a free, no-obligation review of the best terms available. Would you like to speak with them now for this free assessment?

👍🏼YES: Great, let’s continue.

👎🏼NO: Confirm a better time to call back.

Next Steps:

Before we connect you with a specialist for your free evaluation, I need to ask a few quick questions to ensure we have all the details right:

Screening Questions:

1) How many months have you missed your mortgage payments?

2) What is your monthly payment amount?

3) Could you share your current mortgage balance? And is there a second mortgage in place?

4) What’s your interest rate? Is it fixed or adjustable?

5) Is your property a single-family residence, townhome, or condo?

6) And do you know the value of your property? (Confirmed w/ evaluation models).

7) Are you interested in keeping ownership of your home?

8) What’s your approximate annual income?

Eligibility Confirmation:

Great news! You’ve been pre-qualified for a complimentary Loan Modification assessment. Are you available to chat with a home retention specialist right now and explore your options?

👍🏼YES: One moment while I connect you.

👎🏼NO: When would be a better time to reach you and connect you with a dedicated specialist?

Please stay on the line while I transfer you to a representative who can walk you through the program’s key aspects.

– Lead routed as a warm transfer.

– Call forwarded to loan specialist.

– Data successfully posted to provided CRM and email inbox.

Thank You!

Lead Example:

*Date: 9/18/2024 12:47

*Lead Ref: 29501439

*Segment: Loan Modification

Applicant Information:

*First Name: Kelly

*Last Name: Ulman

*Phone-1: 813-207-****

Phone-2: 941-875-****

*Email: kellbell*****@gmail.com

*Address: 37942 N. Suwanee Ave.

*City: Tampa

*State: FL

*Zip: 33604

Co-App First: John

Co-App Last: Ulman

Financial Information:

*Income: $74,000 / year

Employed: 22 years

Status: Laid Off

Age: 59

Date of Birth: 3/17/19**

*Credit Grade: B [Very Good: 740 – 799]

Loan Information:

*Mtg Balance: $405,000

*Loan Amount: $405,000

*Property Value: $530,000

*LTV: 76.41%

*Interest Rate: 6.875%

*Rate Type: Fixed

Lender: Wells Fargo

Payment: $2,175 /mo

Payment History: 3 months late

*Property: Single Family Home

*Assessment Type: Loan Modification

Property Purchase Details:

Purchase Amount: $495,000

Purchase Year: 2017

Most Recent Loan: 2017

2nd Mortgage Details:

Lender: none

Balance: $0

Interest Rate: 0%

Rate Type: none

Payment: $0

Transfer Details:

*Call Status: Connected

*Specialist: Gary Young

*Transfer Agent: Anita Foster

*Order #: 24083186

Call Notes:

Kelly was recently laid off from her employer after 22 years. Her husband, John, is on disability and not able to work. Ready to talk with a loan modification specialist about options to help keep their home.

IP Address: 97.76.232.230

* required

Let’s Advance on Your Next Conversion!

For cutting-edge marketing that surges ahead in the modern digital frontier, contact Expert Lead Source today and experience conversion power!